P L Us Gaap

This guide was fully updated in october 2019 which included adding a chapter describing the differences related to accounting under the new leases standard.

P l us gaap. With this in mind we. A four volume printed set of the accounting standards codification is also available to consult in the library collection. P l format 2 annual statement. Similarities and differences guide outlines the major differences between ifrs and us gaap that exist today.

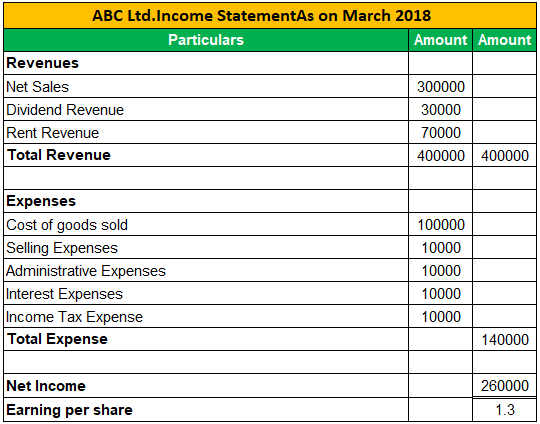

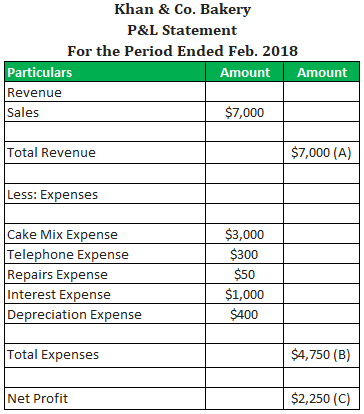

This format is suitable for any size company and can easily be customized. Example 1 single step income statement. Accordingly we believe that an understanding of the differences between ifrs and us gaap will continue to be of keen interest to preparers and users of financial statements. Here xyz is a us based company that follows gaap.

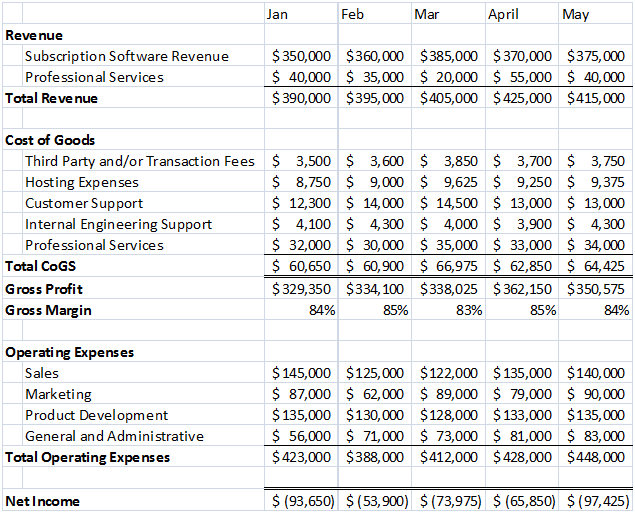

Are pleased to publish the 2015 edition of our comparison of ifrs and us gaap. Us gaap financial statements source. Like us gaap the income statement captures most but not all revenues income and expenses. This type of profit and loss statement format is widely used by companies in operation for many years.

Us gaap in full text. Gaap may be contrasted with pro forma accounting which is a non gaap financial reporting method. Basic us gaap chart of accounts. Both small and large companies use such a format.

As the current non current status of an item is a disclosure rather than recognition issue incorporating the current non current distinction into the account structure not only adds unnecessary complexity but can lead to unnecessary item reclassification. Internationally the equivalent to gaap in the united states is referred to as international. Selling expenses sales salaries and commissions 202 644 sales office salaries 59 200 travel and entertainment 48 940. The cross mark means that the concept was not present in the taxonomy version for the corresponding year.

In this the classification of all expenses are mentioned under this head. Income statement example gaap generally accepted accounting principle has two classifications. Then they are deducted from the total income to get net income before tax. Gaap perspective presentation of the income statement under u s.

Their us gaap information in sec filings. Gaap follows either a single step or multiple step format. Examples include the fair value remeasurement of certain equity instruments remeasurements of defined benefit plans and the effective portion of cash flow hedges change in fair value. The ifrs and us gaap.

These us gaap reporting templates are based on the official financial reporting taxonomy 2013 2019.